For space industry followers, it is perhaps no surprise that the concept of “dual-use technology” has become something of a buzzword in recent months. As an era characterised by relative global security stability and a flourishing of internet-enabled technologies, the 2010s were a golden age for start-ups looking to make an impact in space. And, with interest rates hovering around zero, cash-rich investors were eager to participate with a view to finding some big winners.

But the post-Covid world is a very different place; security is a top priority and investors are looking for growth from money that could be earning good returns in, say, the safety of bonds. So, projects that just a few years ago looked like worthwhile bets are now more attractive when government – defence – customers look likely.

To explore this shift, FINN spoke to Elizabeth Seward, pictured, head of space strategy and future business at BAE Systems. The aerospace industry giant’s space intelligence and technology web page sums up the prevailing situation with the headline declaration: “Innovation in space is at the heart of achieving military and economic advantage on the world stage”.

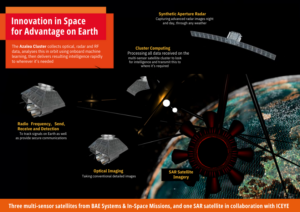

A meaningful response to that essential reality takes a nuanced approach, though. First, Seward observes that BAE Systems is “a large defence company at its heart” which has over several years been making a “skew or tilt” towards exploiting the potential applications that come with the availability of large amounts of data acquired from space by commercial operators. A good example is BAE’s in-development Azalea mission – a constellation of satellites designed to collect multi-spectra data for in-orbit processing into actionable intelligence, where Finnish synthetic aperture radar satellite operator Iceye is a partner.

But, she stresses, to provide a service that is useful to defence and security clients there must be a recognition of the limitations of commercially acquired data. One issue is reliability, where the standard is necessarily higher for military use. Another is priority – do military or security clients have first access when they need information urgently?

BAE System’s strategy, then, is to “position ourselves in the middle” – between commercial, entrepreneurial innovators in the so-called “new space” industry and the established industrial domain that is BAE System’s familiar territory, she says.

That middle position looks like an influential stance for BAE Systems. Seward flags up two distinguishing factors which could make the company a trendsetter. First, the UK space industry is extremely strong; the Harwell innovation cluster near Oxford is a real hot spot for “new space” talent while the UK, to cite just one example, has been a “world leader for decades” in secure telecommunications.

At the same time, the UK Space Command is just three years old and the government is really only beginning to build a space industrial plan. So BAE Systems, she says, is in a good position to “support and champion” this trend.

Second, those who look to government-military budgets for significant uplift should distinguish between the USA and other markets. While the US military budget is big enough to fully mature dual-use technologies, other countries’ defence budgets are, as Seward puts it, “less generous”.

What that means for the UK, notes Seward, is a greater emphasis on innovation. That is, the UK needs to ask carefully what capabilities it needs and how it can access them.

So, she stresses again, a good balance needs to be struck between that entrepreneurial “new space” strength of innovation and the reliability that must underpin systems for military use.

Of the many strengths that an aerospace major like BAE Systems can bring to this effort, striking that balance between exotic performance and dependability may be high on the list.

Elizabeth Seward recently addressed the UK’s strategic role in space in an extensive podcast interview presented by the Council on Geostrategy, sponsored by BAE Systems in partnership with the UK’s ADS aerospace-defence-security industry association. Listen here

Subscribe to the FINN weekly newsletter

You may also be interested in

BAE Systems’ F-15 survivability system completes testing

BAE Systems awarded contract to support Mobile Deployable C5ISR programs

BAE Systems secures approvals for acquisition of Ball Aerospace