Boeing remains the world’s most valuable aerospace and defence brand, despite an 8% decline in brand value to $16.2 billion, according to new data from Brand Finance, a leading brand valuation consultancy.

Airbus remains second ranked with a brand value of $16.1 billion but gains on Boeing, propelled by a 12% increase in brand value since the 2023 ranking.

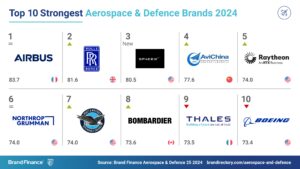

Brand Finance data indicates the Airbus brand is showing resilience and strength as it is again the world’s strongest Aerospace & Defence brand, with a Brand Strength Index (BSI) score increase of two points, maintaining its AAA- rating.

Savio D’Souza, director, Brand Finance, said: “Resilience is an emerging theme of the 2024 Aerospace & Defence Brand Ranking, with Boeing and Airbus top ranked.

“For Boeing specifically, this is a remarkable outcome, given the pressing reputational and financial hurdles the company currently faces.

“The forward look for top ranked brands is optimistic, given the healthy order backlogs, rising demand across different functions within the sector, and economic environments post-pandemic.”

SpaceX makes its debut into the top 10 ranked Aerospace and Defence brands with a brand value of $3.5 billion.

According to Brand Finance research, SpaceX’s strong operating margins has positively contributed to its BSI, scoring well in terms of higher price premium scores.

Brand Finance analysts have found this financial health signals SpaceX’s robust market positioning and its ability to command a premium based on brand strength alone.

As SpaceX continues to push the boundaries of space technology and exploration, its brand value is likely to further ascend, underpinned by innovative breakthroughs and expanding global reach.

Hanwha Aerospace has become the fastest-growing brand in this year’s ranking, up 33% to $927 million. Rheinmetall AG (brand value up 31% to $1.5 billion) and AviChina (brand value up 22% to $1.5 billion) are two distinct but thriving sectors within the broader aerospace and defence landscape.

Both brands underscore the importance of strategic market positioning, operational excellence, and the ability to adapt to evolving market dynamics.

Rheinmetall’s focus on defence technology and armament production and AviChina’s emphasis on civil aviation growth exemplify two different pathways to enhancing brand value within the A&D sector. Bombardier (up 22% to $1.3 billion) also surged in terms of brand value on the back of a rise in private jet sales in key markets.

Subscribe to the FINN weekly newsletter